Thursday, April 28, 2011

Consumption taxes

In a sales tax, the tax on a particular item (or service) is calculated and assessed only on the end-user. The manufacturer, wholesaler and retailer pay nothing, only the final consumer or purchaser pays. Of course, the "middlemen" – manufacturer, wholesaler, retailer e.g.—must have government documents to show that they are not end-users. (The middlemen may have to pay income taxes on their profits, of course.) The retailer must then collect the sales tax from the customer and send it to the government.

In the case of a VAT, each middleman pays the previous middleman for an item, then does something to increase the value of the item (hence the name "Value Added Tax"), then sells the item at the increased price, which includes tax, to the next in line. Each middleman then pays the government the tax charged for the “improved” item less the tax paid by the previous middleman. Thus, each middleman ends up paying the government only the tax on the value that his/her contribution added to the item. Since the final consumer has now paid the full price on the total value of the item (to the last intermediary), and resells to no one, the consumer owes the government nothing. In effect, the government is collecting the same total in taxes as with the sales tax, but is paid by the intermediaries -- who are paid stepwise by each other and, finally, by the end-user or consumer.

For more details and numerical examples of how this works, see the Wikipedia article on VATs.

Since only the consumer under a sales tax pays the government, the intermediates have no stake in whether the next person pays tax or not. With a VAT, however, everyone pays tax (unless they illegally falsify their records) and so the intermediates need to keep track of input and output in order to justify paying the government just the difference in taxes (they have already payed the intermediate preceding them).

Thus, VATs and sales taxes are really not that different in terms of money collected, but the VAT may be an improvement in the integrity or honesty of collection -- although it has been argued that its complexity may make up for that. The VAT is certainly more effective in collecting taxes on Internet sales since these taxes are all collected before the item is sold on the Web.

Both sales taxes and VATS vary a lot from country to country, and from state to state in the U.S. (and some cities also). The EU has certain ground rules for its member nations, though a considerable amount of flexibility is still permitted. There are no national rules in the U.S. on states' taxes, but most are deductible, at the present, from federal taxes.

The problem with consumption taxes is that they tend to be regressive; that is, their burden falls heaviest on lower income people, and lightest on the very rich. The reason, as is so often the case, relates to disposable income. Everyone must eat, drink, obtain shelter and medical care, and be able to get around; to do this, people usually have to make purchases: food, clothing, medicines, houses and cars, for example. For lower income families, these necessities require a large percentage of income -- sometimes all; taxing them creates quite a burden on a family's financial resources. Wealthy people, on the other hand, have a lot of income above what they need to live, even if they have expensive tastes. This income is only subject to a consumption tax when and if it is spent: it is discretionary or disposable. Thus, the consumption tax burden on these affluent families tends to be much lighter than on poorer ones.

A lot of the variation in consumption taxes results from the desire to mitigate this regressive nature. Certain basics such as food, shelter and medicines may be taxed at lower rates or not at all. For example, the EU excludes charities, health and education from the VAT, while Massachusetts doesn't tax food, clothing and medical care in its sales tax.

The regressive nature of consumption taxes may also be partially neutralized by fixed lump-sum payments to all taxpayers, or by combining VATs, say, with a highly progressive income tax (i.e. one that has much higher tax rates for those with high incomes).

An interesting example is Denmark, which has a very high but fairly progressive income tax, combined with the highest VAT in Europe: 25%. The result is the highest combined tax rate in the world, a good part of which is the regressive VAT, to which there are hardly any exceptions. Yet, Denmark also has one of the most financially egalitarian economies in the world. This is because the high taxes are used in a very progressive way: on social spending, retirement security, and medical coverage. It is exactly that segment of Danish society which is hit so hard by the regressive VAT that benefits most from this spending. The Danes believe, and with good reason, that their government is part of the solution and not the problem. Of course, it is their government and they have created it to be progressive and humanitarian: they don't fight very many wars, and have been at the forefront of development of agricultural products and wind power.

How then should we react to suggestions that the U.S. introduce some sort of VAT? At this point in our history, when the "cut-the-deficit-by-any-means" forces are rampant, I think it would be very dangerous to create anything so inherently dangerous to economic democracy as a federal consumption tax. The political armies of the reactionary right, consisting of the know-nothing Tea Screamers and the Chamber of Commerce and Club For Growth, as well as the beneath-contempt Republicans, seem more likely to do true mischief to most poor and middle-class Americans than can be countered by the confused and divided Democrats. Sufficient unto the day is the unfair tax policy thereof.

In any case, here's a litmus test for any consumption or VAT tax that may be proposed. Does it contain a Financial Services or Securities Transfer tax (see my blog on the Parasite Tax) on the purchase and sale of stocks and bonds? If it doesn't, you can be sure that it is a stalking horse for yet more regressive taxes that favor the rich.

Tuesday, April 26, 2011

Winning Progressive on Krugman's column

My comment on Paul Krugman’s NYT column Let’s Take a Hike, which focuses on the need for tax increases, such as those proposed in the House Progressive Caucus budget, as a core element of any deficit reduction plan:

First, in response to your question about why, if the deficit is purportedly such a serious problem, are Republicans proposing further tax cuts, the reason is that the Republicans are not serious about reducing deficits. They intentionally created deficits in order to make their efforts to eliminate Social Security, Medicare, and other core government programs that help average Americans politically palatable. They haven’t succeeded in that goal and, therefore, Republicans hope to continue pushing the deficit up until they do succeed.

Second, thank for highlighting the House Progressive Caucus budget proposal. As you note, by asking the wealthy elite to begin paying their fair share again and cutting defense spending and corporate subsidies, The People’s Budget reaches fiscal balance in 10 years, which is far quicker than either Rep. Ryan’s Path to Poverty plan or President Obama’s proposal. In the parlance than the chattering classes like to use, it is the House Progressive Caucus proposal that is serious, as it uses real numbers and policies to achieve actual fiscal balance without further undermining our middle class or preying on the least fortunate among us.

Third, in addition to the insincerity of the so-called “deficit hawks” (who are really deficit vultures for the reasons identified in my first paragraph above), the other reason that the House Progressive Caucus budget has not received much attention is because it goes against the conventional wisdom peddled by the chattering classes. That “wisdom” holds that cuts to Medicare and Social Security are necessary, that taxes cannot be raised, that defense spending cannot be touched, and that programs for the middle class, working class, and the least fortunate among us must be slashed. And the reason those points constitute “wisdom” in DC is that the chattering classes are in economic circumstances that foreclose them from personally experiencing the critical importance of programs like Social Security and Medicare and cause them to worry more about being asked to pay their fair share, and because most of our media enjoys the war porn that creates ratings for their networks.

A final point is that these contrasting visions of our nation’s fiscal future are really about what sort of Country We Believe In, as our President explained in his recent speech on fiscal policy. Do we want a nation that continues to lavish spending on the military and let’s the richest few percent continue to amass boatloads of wealth while our infrastructure and education system crumbles, security for our senior citizens disappears, and the social safety net is shredded? Or, do we believe in an America where we can once again have a stable middle class, where people who worked all their lives can have a secure retirement, where our children receive world class education, where our infrastructure system is again the best in the world, and where all are asked to pay their fair share for the cost of civilization? If you share my belief in the latter vision of America, now is the time to get involved in making it happen.

Monday, April 25, 2011

More seriously: Social Security taxes

This cutoff was created to "save Social Security" through the efforts of a bipartisan panel during the Reagan years. In those days, even under the conservative Ronald Reagan, it was possible to deal rationally with Republicans. Some of the history and reasons (e.g. income inequality) why that cutoff level is no longer sufficient is presented in this week's GoozNews: it's worth reading.

Good comic

Saturday, April 23, 2011

Taking his word?

No, they aren't and shouldn't be taking "his word for it." They are and should be taking the official word of the state of Hawaii. The document is the only birth certificate Hawaii issues upon request. It is the official document; it is the legal last word. When these Republicans claim to show their own birth certificates, they are showing a document no more and no less compelling than this document.

Taking "his word for it" is condescending BS and indicates that they still cling to some hope that they can extract political advantage from the "birthers". What part of "beneath contempt" don't I understand? I better sign off here.

Friday, April 22, 2011

Inheritance taxes

If this wealth is passed down via inheritance, the result is a few very wealthy families with not only immense economic power from their huge financial holdings, but with the vast political power that such wealth can purchase through lobbying and political donations.

If this wealth is passed down via inheritance, the result is a few very wealthy families with not only immense economic power from their huge financial holdings, but with the vast political power that such wealth can purchase through lobbying and political donations.The Founding Fathers (Madison, Jefferson, Adams etc.) saw these effects of concentrated inherited wealth in Europe and were fearful of them. In a letter to Madison, Jefferson wrote: “Another means of silently lessening the inequality of property is to exempt all from taxation below a certain point, and to tax the higher portions of property in geometrical progression as they rise.”

The distaste for vast inherited wealth was, throughout American history, not confined to any political party.

Teddy Roosevelt said that federal taxes should “put a constantly increasing burden on the inheritance of those swollen fortunes, which it is certainly of no benefit to the country to perpetuate.”

Herbert Hoover, a conservative Republican, described the inheritance tax as "one of the most economically and socially desirable—or even necessary of all taxes" to curtail the "evils of inherited economic power."

There is an unbroken line of belief, from colonial times to the present, in progressive income taxes and inheritance taxes. They are as American as apple pie.

Wednesday, April 20, 2011

Tax cuts and tax fairness

First of all, whether there are tax cuts or tax increases, the history of capitalism in this country has always been one of recurring "business cycles." These comprise a period of growth (G) then a period of leveling off of growth (L) culminating in a peak (P); these are followed by recessionary periods of varied seriousness (R), then a leveling of decline (L), then a repetition. Schematically, then, we have the cycle:

The general path of the economy in the U.S. has been upward: most business cycles end in a recovery with the economy in a better state than it had been in the previous cycle, measured in terms of investment and GDP growth. On average this increment from peak-of-cycle P to peak-of-cycle P has been around 2%. There is also the matter of average (over the cycle) real tax revenue per capita; this is a measure of how much the government is actually taking in per person, adjusting for inflation.

Note the phrase "on average." Results do vary from cycle to cycle, which enables us to make comparisons between business cycles and tax policies. In the early '80s, under President Reagan there were a series of "supply-side" cuts in the tax rates, where "supply side" means favoring the investing class. Again, in the early years of the 21st century, the Bush Tax Cuts cut the rates for investors and the wealthy (both supply-side + "trickle down" theories at work). In between, in the '90s there were tax increases on the wealthy under President Clinton. How did these varying tax policies, based on competing economic theories, effect the business cycles?

The answers are quite clear. Comparing the Reagan and Clinton cycles, the recoveries from the recessionary periods of the respective business cycles were quite similar; (about 2%); however, the per capita tax revenues under the Clinton recovery were about twice the size as those under the supply-side Reagan recovery. Thus, the supply-side theory fared no better in terms of recovery, but was a real drag on government revenues. This is part of the reason that, rhetoric aside, the Reagan "conservative" theory resulted in deficits, while the Clinton administration actually achieved the budget balance that the Reaganites merely talked about.

Moving on to the next business cycles, the comparison between the Clinton and Bush years is even more noticeable. The improvement in the economy (investment and GDP growth), from P to P, from Clinton to Bush, was somewhat lower than the historic improvement, but the tax revenue increase was no more than 1/2 % -- virtually nil in comparison with the average over the last 50 years of about 10% (11% under Clinton).

Thus, in terms of economic recovery, there is no discernible difference between Republican/conservative and Democratic/liberal tax policies. But, in terms of real per capita tax

In the crucible of real-world testing of economic theories -- the only meaningful test, after all -- the conservative program has failed. As the handwriting on the wall says from Daniel 5: "Mene mene tekel upharsin" ("You have been judged in the balance and found wanting").

The data backing up these remarks comes from official statistics reproduced by the Center on Budget and Policy Priorities in this report. Please check it out: it has references to many other sources.

Now we come to "fairness" -- truly a thorny issues. Conservatives like to point out that after the Reagan and Bush tax cuts, the percentage of income tax collected from the top 1% (99th percentile) of tax payers went up, while the share from the lower income percentiles went down. This is supposed to show the liberals that cutting taxes for the rich is some sort of Robin Hood scheme. This is baloney for several reasons. First of all, the actual marginal (highest rate of taxation, or the tax on the last dollar of income) tax rates on the richest 1% are at an all-time low, so that the burden that they pay as individuals is lower than ever. So why are they paying more? One reason is that their income, in comparison with the incomes of the lower brackets, has soared in the last few years (since the '50s and '60s). The wealthiest 1% now make about 24% of all income; furthermore, their income is the highest multiple of the lowest percentile income since 1928: just before the Great Depression.

Here's how Nicholas Kristof of the NY Times puts it:

"The richest 1 percent of Americans now take home almost 24 percent of income, up from almost 9 percent in 1976. As Timothy Noah of Slate noted in an excellent series on inequality, the United States now arguably has a more unequal distribution of wealth than traditional banana republics like Nicaragua, Venezuela and Guyana.

C.E.O.’s of the largest American companies earned an average of 42 times as much as the average worker in 1980, but 531 times as much in 2001. Perhaps the most astounding statistic is this: From 1980 to 2005, more than four-fifths of the total increase in American incomes went to the richest 1 percent."

So, they pay a larger percentage of taxes because, in comparison, they are many many times wealthier. Even the top 5% have seen their real income more than double since the 1960s, while the real (adjusted for inflation) income for the lower brackets has remained amazingly constant since 1965. Another reason their tax contribution has gone up is not so much that their marginal rate has gone down but that the kinds of deductions which they can take have been tightened. These include certain business (no more "three-martini lunches e.g.) and certain limitations on mortgage and home equity interest deductions. Similar changes in the standard and child-care deductions have helped the people in the lower income brackets. Conservatives claim that lower tax rates have made the wealthy less likely to hire expensive tax preparers to find loopholes in the tax rules -- I don't buy this and I haven't seen anything but anecdotal evidence to support it.

Mother Jones magazine has compiled more statistics about taxes and incomes of the rich; you can find the article here.

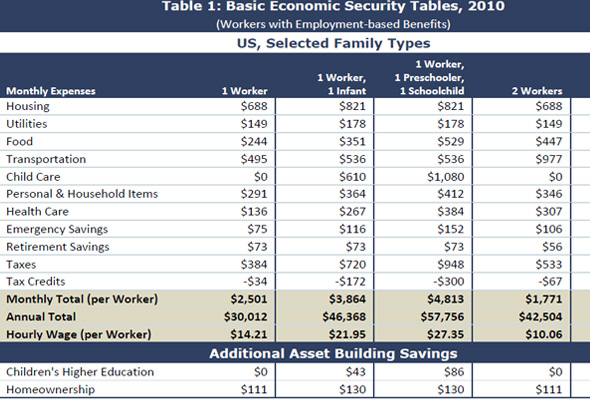

Now, of course, there are those who question why the wealthy should, in fact, pay higher (marginal) tax rates at all. Why, they ask, shouldn't everyone pay, say, 15% of their income? In other words, what justification is there for a graduated income tax? And here we come to the issue of fairness and the concept not so much of taxes as tax burden. To see what's at issue here, let's look at a hypothetical case. I got the following table from MainSt, a non-partisan middle-class financial magazine.

Column 4 represents the finances of a typical family of four with one wage earner. In order to afford the very basics of middle-class life, the hourly salary of the breadwinner must be $27.35 an hour -- with no savings for college and no homeownership. Note that there are absolutely no frills or leeway in this family's finances. One might say that this family has no disposable income. Thus, there is no money for vacations, gifts, parties or dining out. This family is slightly above the median for Americans.

Now imagine a similar family with a yearly income of $135,000, paying even triple the taxes of the first family. This family would have an additional $6,000 per month of income to spend at their discretion: to pay for a house, fancy vacations, tuition at a good college etc. This extra money also buys them less financial stress (which puts a great strain on marriages) and opportunities for personal enrichment such as plays, concerts, music lessons and sports. This family is somewhere in the top 5-10% of American families: not rich by any means, but firmly secure.

It is clear that the tax burden of the second family is far lower than that of the first. In the interest of fairness, we believe that every hard-working family deserves a measure of financial security, educational opportunity, and even a little left over (disposable income) for recreation and relaxation. Thus, to allow this, generations of Americans have agreed that the tax burden be shifted to those families with more disposable income.

To do this, we have a graduated income tax, with gradually increasing rates of taxation for the various segments of a taxpayer's salary, starting from the lowest. Thus, one might pay nothing for the first $20,000, 10% on the next 20,000, etc, up to the highest segment which is taxed at the "marginal" rate. At one time there were literally dozens of segments, and the tax forms had very simple charts where you looked up your taxable income; the chart said something like: "Pay $3700" plus [some percentage] of your income over [a certain number of dollars]." Even before calculators, you just needed one multiplication and one addition to find what you owed.

Another possibility is to have a fixed tax rate for all "earned income" (as we do in Massachusetts), but with a large initial exemption (amount subtracted before calculating taxes) to account for fixed expenses (non-disposable income) -- the theory being that the government should notextract tax money on what you need simply to live. This kind of tax system is not as fair as the graduated one, but it is hard to get people to see this because most people don't want to do the math to make the comparison. When Massachusetts had a referendum on the graduated income tax, large businesses and wealthy people launched a campaign that eventually convinced a large majority of the people who would have benefited from this reform to vote against it. (Opponents said that the calculations would be too complicated to understand, and that, by some infernal, magical gimmick, "the government" would somehow extract more money from you: the usual Big Lie propaganda technique.)

Anyway, thanks for you patience if you've read this far.Monday, April 18, 2011

Healthcare talking points from Merrill Goozner

Below is his presentation of useful talking points concerning the IPAB (independent Payment Advisory Board), set up by the recently passed Healthcare Bill. I copied this directly from Goozner's website.

"Sen. Tom Coburn (R-Okla.) and Rep. Chris Van Hollen (D-Md.) squared off on Fox News Sunday over the best way to hold down medical costs in the years ahead. Coburn, a physician, focused exclusively on public programs like Medicare and Medicaid, and hewed to the new Republican extremist position that favors privatization and higher individual payments. “Until we reconnect payment with purchase, you can’t fix it,” he said. “There’s no way the government is going to drive down costs without rationing.”

Host Chris Wallace honed in on that point when he turned to Van Hollen by attacking the Independent Payments Advisory Board set up by the health care reform law. Typical of the rightward slant of the program, he asked if Democrats really believed a government panel of “experts” — said with a sneer — could do a better job than the market.

Van Hollen badly fumbled his response. He started by explaining that Medicare isn’t the whole health care system, and then said the best way to hold down costs was to hold down costs in the entire system through the Affordable Care Act. Then he retreated to the stock Democratic line that Medicare was created precisely because when it came to insuring seniors, “private insurance companies would not do it.” Even to this wonk, he response was barely coherent.

Moreover, he never responded to Wallace’s question, which most viewers would get right away. So listen up all Democrats. Here’s my talking point if you’re asked the “do you want government experts” dictating your health care choices question (which is code for the IPAB set up under the health care reform law):

Far better to have a government panel made up of representatives of every constituency involved in health — hospitals, doctors, drug and device companies, patients AND consumers — which the law says must come up with its proposals in public session, which are then submitted to Congress for a yes or down vote; than to have insurance companies make those decisions using their own so-called expert panels, which will be made up of insurance company executives and the doctors they hire; whose deliberations will be conducted in secret; and whose decisions will be made without any public input and without public recourse — except protest — if you don’t like the decisions they impose.

(If you have additional time): By the way, that’s what happened the last time we completely turned over decision-making to the insurance industry. Remember the late 1990s and HMOs? They cut access to health care indiscriminately, which led to massive public protests because of their poor choices in denying care. When Congress almost passed a patients bill of rights, the insurance industry gave up trying to control costs and simply passed along every price increase. That created the near disastrous situation we face today in terms of escalating costs in private insurance plans, just as we have unacceptably high increases in our public programs.

Everyone says we have to cut spending on health. I’ll take a public board with transparency and public accountability every time over turning those decisions over to a private insurance company whose sole motivation is increasing its bottom line. You say Democrats are for rationing? The people opposed to health care reform are the real rationers. Only they would ration by price, not by publicly accountable boards making science-based decisions to not pay for ineffective, costly care."Saturday, April 16, 2011

Business cycles and the Bush tax cuts

"Sorry, but I must disagree. Before the Bush tax cuts the economy was NOT booming. How can you forget the 2001-2002 recession? That's why the tax cuts were enacted in an effort to kickstart the economy."

This is correct. What I should have said is that, at higher tax rates, the economy during the Clinton years was generally very strong if not "booming"; however, starting near the end of Clinton's second term and the beginning of the first Bush term, there was a recessionary period generally considered to be part of a normal business cycle ( growth - leveling off - recession - recovery). Bush, like most Republicans, was not a Keynesian, but he did enact some of the most costly tax cuts during this first term. (Moderate tax cuts and increased government spending are generally part of the Keynesian prescription for ameliorating the recessionary parts of the business cycle.) It is also interesting that these cuts were "temporary" -- there was politics as much as economics involved in their size, distribution and timing. Nevertheless, they were followed by one of the weakest "recoveries" (beginning of a new cycle) in modern times, followed by the worst recession and unemployment since the Great Depression. The Bush Tax Cuts, far from creating a robust economy and new jobs, as the conservative economists -- perhaps disingenuously -- predicted, were part of a disastrous economic policy whose consequences are still being felt. Of course, this disaster was not due solely to the tax cuts, since deregulation of financial speculation, especially in the mortgage industry, played an even larger role; unfunded wars and an unfunded prescription drug plan designed by Big Pharma didn't help either. In fairness, the deregulation, as I have pointed out earlier, was partly Clinton's and his economic advisers' fault.

So, in the context of the normal business cycle, I think it is fair to say that the Clinton years, in which taxation was at or higher than that of Bush I's term, was a period of robust growth and balanced or nearly balanced budgets, while the period after the Bush II cuts saw weak growth then rapid and prolonged downturn, accompanied by a rapid accumulation of debt.

(None of this had anything to do with Obama or health care, incidentally.)

Friday, April 15, 2011

What I told the AARP

Today they had a news item about the Republican budget being debated in the House. I posted the following comment.

The Republican budget plan is the biggest threat to middle class and poor seniors in our generation. It will not just eliminate Medicare "as we know it", it will effectively eliminate Medicare. The reason is simple: it will force seniors to use government "vouchers" to purchase health care on the open (private) market. However, as anyone can imagine, the cost of an insurance plan for someone over 65, especially if you have a pre-existing condition (as most of us do) will be astronomical. The most expensive care for most people occurs during their later years; we know that and surely the insurance companies know that. They will either refuse to issue policies, or the policies will be so expensive that the "voucher" will be effectively worthless.

The Republicans are "saving money" simply by eliminating a program and asking us as individuals to pay. This reasoning could also apply to Social Security, highway building, meat inspection and even national defense. In fact, except for the military, that's exactly what the Party for The Rich = PTR (formerly GOP) is planning to do.

The Republicans have always been, and still are, the party of wealth. Ask anyone who grew up during the FDR era, for example. That's exactly why they are pushing tax cuts for the rich. -- it's what they always do. If these cuts were really producers of jobs, how come we've done nothing but lose jobs ever since they were enacted by George Bush?

If AARP doesn't fight this Republican attack on the middle class, and especially this attack on seniors, with every means at its disposal, it will be letting down every single one of its members except those few who are very wealthy.

Write to AARP about this, and read my blog for more independent political commentary:

http://thatmansscope.blogspot.com/

I suggest that you write similar letters to AARP and any other organization whose members will be hurt by the Republican budget. This piece of legislation is so terrible that we must do everything we can to defeat it and to make sure that people know why it's so bad and to make sure that it is thoroughly identified with the Republicans, the Party of The Rich.

Thursday, April 14, 2011

Another discussion of Obama's speech

The Republicans are already calling Obama's proposed elimination of the Bush Tax Cuts "job-destroying." Interesting. Before the cuts the economy was booming and unemployment was low. After the cuts ... well, you know what happened. How could eliminating these cuts possibly work out worse than the results of enacting them?

To paraphrase Sarah Palin's line: How's that tax-cut-y thing workin' out for ya?

Wednesday, April 13, 2011

The Annotated Budget Address

You can find the entire speech here.

I would like to know exactly why the President decided to give this speech in the middle of the day. Was there a strategic or tactical reason for not having his exact words being heard during prime time, or was there no network time available to him? When I watched the national news this evening, his speech was not even the top story of the day, and only brief snippets were shown. Couldn't he have made this rare "bully pulpit" excursion more public? Anyone know?

Anyway, returning to the speech itself: after some introductory remarks, he set the general tone by reminding us of the "social contract" that has been tacit in America for over two centuries:

We believe, in the words of our first Republican president, Abraham Lincoln, that through government, we should do together what we cannot do as well for ourselves.

How easily the Republicans and Tea Screamers forget that the American Constitution and Declaration of Independence sit squarely in the strong tradition of the social compact: that we unite and govern ourselves in order that each of us can join collectively to help our fellow citizens. Here's the beginning:

"We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity, do ordain and establish this Constitution for the United States of America."

Note how often the "promote the general Welfare" is left out of the discussion by the folks who so often talk about the "common defence" and wave the flag so much. "General Welfare" sure must sound like socialism to them.

(Pursing the military terminology: Should Gen. Welfare outweigh Pvt. Profit?)

Part of this American belief that we are all connected also expresses itself in a conviction that each one of us deserves some basic measure of security. We recognize that no matter how responsibly we live our lives, hard times or bad luck, a crippling illness or a layoff, may strike any one of us. "There but for the grace of God go I," we say to ourselves, and so we contribute to programs like Medicare and Social Security, which guarantee us health care and a measure of basic income after a lifetime of hard work; unemployment insurance, which protects us against unexpected job loss; and Medicaid, which provides care for millions of seniors in nursing homes, poor children, and those with disabilities. We are a better country because of these commitments. I'll go further – we would not be a great country without those commitments.

At one time in this country the lot of the poor, the weak and the elderly was quite harsh and only slightly ameliorated by the work of private charity. When people became aware of these conditions through the work of progressive reformers such as Jane Adams, Jacob Riis, Upton Sinclair etc. they became outraged and the reforms began that culminated in the New Deal and the "safety nets" that Obama refers to. For many decades only hard-core reactionaries referred to as "socialist" the child labor laws, the laws recognizing labor unions and standards for pure food and drugs, and Social Security. Unfortunately, this reactionary Empire is striking back by trying to underfund and undermine these social commitments that identified us as a "great country."

For much of the last century, our nation found a way to afford these investments and priorities with the taxes paid by its citizens.

Yes, and that is part of the "social contract": we don't like to pay taxes but most of us have recognized that that's the only way we can do what we believe needs to be done. These laws and taxes didn't just appear: they were passed by our democratically elected representatives. The original Boston Tea Party wasn't particularly against taxes, it was against taxation without representation (in the Houses of Parliament). The taxes we now have were instituted exactly by us, in a democratic, representative way. They reflected the will of the majority of the people, as expressed democratically through the mechanisms provided by our Constitution.

As a country that values fairness, wealthier individuals have traditionally born a greater share of this burden than the middle class or those less fortunate. This is not because we begrudge those who've done well – we rightly celebrate their success. Rather, it is a basic reflection of our belief that those who have benefited most from our way of life can afford to give a bit more back. Moreover, this belief has not hindered the success of those at the top of the income scale, who continue to do better and better with each passing year.

Actually, to this I'd add that wealthier individuals may pay a greater share of the tax dollars, but they don't necessarily bear a greater share of the burden. "Burden" is measured by the effective load that one bears; in terms of wealth this must be measured by the "pain" one incurs in meeting the tax obligations. If one's tax dollars come out of one's food, medicine, or shelter, then that is a great burden. If one's tax dollars come out of funds available for diversion or luxury, then that is less of a burden. Such funds, which are over and above the costs of mere living, are called "disposable income," and part of the definition of "wealthy" or "upper class" is that one has a large disposable income. In assessing tax burden then, you must take into account both the actual labor represented by the tax dollars, as well as the actual economic pain of paying them. By these standards it is not at all clear that the larger amount of taxes that the rich pay actually represents a greater burden: paying with fat is easier than paying with bone and sinew.

But after Democrats and Republicans committed to fiscal discipline during the 1990s, we lost our way in the decade that followed. We increased spending dramatically for two wars and an expensive prescription drug program – but we didn't pay for any of this new spending. Instead, we made the problem worse with trillions of dollars in unpaid-for tax cuts – tax cuts that went to every millionaire and billionaire in the country; tax cuts that will force us to borrow an average of $500 billion every year over the next decade.

To which I would add that this kind of off-budget deficit spending is exactly what radical rightists encourage. As they themselves put it, they want to "starve the beast" -- i.e. waste so much government money that (a) the government can't afford anything else and (b) people will view their government with suspicion and derision. If there are enough unfunded and off-budget programs, there won't be enough left to regulate business -- exactly what people like the Koch's want. These actions to discredit and marginalize our own government are unpatriotic. Until Reagan's "government is the problem" citizens of this country by-and-large respected their government because they knew that it represented them through democratic elections. Yes, we have historically opposed corruption in our government when it was discovered, but that was the fault of corrupt individuals: they were the problem, not our government. Indeed it is truly our government.

So here's the truth. Around two-thirds of our budget is spent on Medicare, Medicaid, Social Security, and national security. Programs like unemployment insurance, student loans, veterans' benefits, and tax credits for working families take up another 20%. What's left, after interest on the debt, is just 12 percent for everything else. That's 12 percent for all of our other national priorities like education and clean energy; medical research and transportation; food safety and keeping our air and water clean.

No comment needed here: this is just useful info. Obama also pointed out that foreign aid makes up [only] about 1% of our entire budget. Fewer than 1 in 4 American realize this; I doubt that any Tea Screamers do.

Obama then turned to the Republican proposals for debt reduction, describing their basis as follows:

It's a vision that says if our roads crumble and our bridges collapse, we can't afford to fix them. If there are bright young Americans who have the drive and the will but not the money to go to college, we can't afford to send them. Go to China and you'll see businesses opening research labs and solar facilities. South Korean children are outpacing our kids in math and science. Brazil is investing billions in new infrastructure and can run half their cars not on high-priced gasoline, but biofuels. And yet, we are presented with a vision that says the United States of America – the greatest nation on Earth – can't afford any of this.

It's a vision that says America can't afford to keep the promise we've made to care for our seniors. It says that ten years from now, if you're a 65 year old who's eligible for Medicare, you should have to pay nearly $6,400 more than you would today. It says instead of guaranteed health care, you will get a voucher. And if that voucher isn't worth enough to buy insurance, tough luck – you're on your own. Put simply, it ends Medicare as we know it.

This is really pretty good rhetoric (for a change). One thing I would add is to ask how likely is it that a person of age 65+ would be able to find an affordable health insurance policy in the private sector? The chance that such a person could find a meaningful use for a voucher sized by Republicans is vanishingly small.

Next Obama turned to a bit of much-needed "class warfare" rhetoric; isn't it about time?

Think about it. In the last decade, the average income of the bottom 90% of all working Americans actually declined. The top 1% saw their income rise by an average of more than a quarter of a million dollars each. And that's who needs to pay less taxes? They want to give people like me a two hundred thousand dollar tax cut that's paid for by asking thirty three seniors to each pay six thousand dollars more in health costs? That's not right, and it's not going to happen as long as I'm President.

Will Obama actually live up to this promise?

One good thing is that Obama is phrasing tax reform not as "increases" but as an action to "reduce spending in the tax code." It's about time we started using our framing of the issues, not theirs.

Next up is military spending.

Just as we must find more savings in domestic programs, we must do the same in defense. Over the last two years, Secretary Gates has courageously taken on wasteful spending, saving $400 billion in current and future spending. I believe we can do that again. We need to not only eliminate waste and improve efficiency and effectiveness, but conduct a fundamental review of America's missions, capabilities, and our role in a changing world. I intend to work with Secretary Gates and the Joint Chiefs on this review, and I will make specific decisions about spending after it's complete.

This is totally vague, with no promises or hints as to where cuts might come. What is needed is to eliminate the troops enforcing the Pax American around the globe. Bring home the tens of thousands of troops from Japan and Europe and dismantle the bases there. End "Star Wars" definitively; stop producing carriers. Bring home the troops from Afghanistan and Iraq and Saudi Arabia. Cut all military aid to non-democratic regimes and replace some or all of the money with humanitarian aid. This is what we need to hear, not vague talk about "wasteful spending and efficiency.

But let me be absolutely clear: I will preserve these health care programs as a promise we make to each other in this society. I will not allow Medicare to become a voucher program that leaves seniors at the mercy of the insurance industry, with a shrinking benefit to pay for rising costs.

This is another promise we will remember.

As I said in the State of the Union, both parties should work together now to strengthen Social Security for future generations. But we must do it without putting at risk current retirees, the most vulnerable, or people with disabilities; without slashing benefits for future generations; and without subjecting Americans' guaranteed retirement income to the whims of the stock market.

We know exactly how to preserve Social Security: tax all incomes without any cut-off. The FICA tax is regressive as it is: it hurts people with lower incomes since it takes more of their disposable income (see above).

Beyond that, the tax code is also loaded up with spending on things like itemized deductions. And while I agree with the goals of many of these deductions, like homeownership or charitable giving, we cannot ignore the fact that they provide millionaires an average tax break of $75,000 while doing nothing for the typical middle-class family that doesn't itemize.

My budget calls for limiting itemized deductions for the wealthiest 2% of Americans – a reform that would reduce the deficit by $320 billion over ten years. But to reduce the deficit, I believe we should go further. That's why I'm calling on Congress to reform our individual tax code so that it is fair and simple – so that the amount of taxes you pay isn't determined by what kind of accountant you can afford.I don't need another tax cut. Warren Buffett doesn't need another tax cut. Not if we have to pay for it by making seniors pay more for Medicare. Or by cutting kids from Head Start. Or by taking away college scholarships that I wouldn't be here without. That some of you wouldn't be here without. And I believe that most wealthy Americans would agree with me. They want to give back to the country that's done so much for them. Washington just hasn't asked them to.

Well, this is a bit of an overstatement, since a lot of the money that is backing the anti-tax movement comes from wealthy people like the Kochs and Grover Norquist; they also cynically support not-necessarily rich but misinformed people like the Tea Screamers. It is true, however, that many wealthy people do have the sense of responsibility that Obama describes: see here for example. I would like to have heard the President mention other means of revenue enhancement, such as a Financial Services or Parasite Tax. Maybe we'll hear about it later, but I'm not holding my breath.

This sense of responsibility – to each other and to our country – this isn't a partisan feeling. It isn't a Democratic or Republican idea. It's patriotism.

Right on.

Friday, April 8, 2011

Ryan's budget proposal

Although Krugman pretty much says it all, I'd like to ask anyone if there is one shred of proof or empirical evidence that cutting taxes "pays for itself" in increased tax revenue. This is exactly what the senior President Bush correctly referred to as "voodoo economics" (along with the "trickle down" theory). I suspect that it is all part of the Republican Big Lie campaign: say something enough times and people will believe it.

Thursday, April 7, 2011

Another interesting website

Monday, April 4, 2011

Nuclear risk and poker

General Electric CEO Jeff Immelt, who was recently appointed by the President to head his Council on Jobs and Competitiveness, defended the nuclear power industry while in Japan this week. When asked by a reporter if the Fukushima incident would cause global concern about nuclear safety he replied:

"This is an industry that's had an extremely safe track record for more than 40 years. We have had more than 1,000 engineers working around the clock since the incident began and we will continue in the short, medium and long term working with TEPCO due to this horrific natural disaster."

Immelt's logic is very peculiar. The effects of this nuclear disaster will be felt in Japan and throughout the world for a good deal longer than 40 years. Is it then OK to have such a disaster every 40 years? How bad a disaster can we afford to have every 40 years? The land around Chernobyl will be uninhabitable for another century at least. Hundreds died there, and more died later and are still dying.

Many years ago, when I first started playing poker, someone made the following point about risk. Suppose, he said, that you hold a pretty strong hand -- say a full house -- in a simple game of draw poker (nothing wild). It's a limited stakes game, so you bet the limit -- say $20. You have one opponent, who calls your bet and raises $20. There are certainly hands that will beat you, but they are not very likely in such a game. So you see the raise -- maybe even raise again. Now suppose we have the same situation, but with unlimited stakes. You bet your $20 but your opponent raises you $20,000. Now what do you do? The odds haven't changed but your problem has changed radically.

So it is with power plants. The stakes are simply higher if yours is a nuclear plant than if it is a wind farm. A safety record of 40 years is not a good enough hand at these stakes.

Sunday, April 3, 2011

Sieverts, Rems etc

Saturday, April 2, 2011

Numbers numbers everywhere

The quote below is from an article in today's Times. It contains all sorts of numbers but no real attempt to assess their significance or even to relate them with each other. Surely we can expect better reporting and editing. Even better, in the online edition (for which I now pay), there could easily be links to glossaries and explanations. As a mathematician I understand, say, half-life, but I don't remember -- if I ever knew -- how many sieverts or sieverts per hour, or becquerels per liter ( in 4 to 8 inches of water spread out over how many square meters or feet or whatever) I should be concerned about. My H.S. science and writing teachers would have taken a very dim view of this mess of mixed metaphors and units.

"Plant workers discovered a crack about eight inches wide in the maintenance pit, which lies between the No. 2 Reactor and the sea and holds cables used to power seawater pumps, Japan’s nuclear regulator said.

The space directly above the water leaking into the sea had a radiation reading of more than 1,000 millisieverts per hour, Mr. Nishiyama said. Tests of the water within the pit later showed the presence of one million becquerels per liter of iodine 131, a radioactive substance. However, iodine 131 has a half life of about eight days.

Mr. Nishiyama also said that higher than normal levels of radioactive materials were detected about 25 miles south of the Fukushima plant, much farther than had previously been reported.

At the time the leak was discovered, the deep pit was filled with four to eight inches of contaminated water, according to Tokyo Electric. But it was impossible to immediately judge how much water had escaped and over how long a period of time."