Saturday, June 18, 2011

Glass-Steagall

Friday, June 17, 2011

Saving money, saving lives

Curing our sick economy

I won't be posting for a week or so.

Monday, June 13, 2011

Medicare

Today's Krugman column in the NY Times reinforces some of the facts from the CBO report I've been reporting on.

Also, if you enjoy a smackdown of lightweight contender David Brooks, also of the NY Times, check out today's Winning Progressive for a cross-post of comments by Bruce Schmiechen who writes for The Titanic Sails at Dawn.

Sunday, June 12, 2011

Germany's economy

Saturday, June 11, 2011

The CBO Report Part II: Further Considerations

As I pointed out in Part I, most of the CBO report was concerned with the healthcare issues raised by Ryan's plan. Although the plan is talks about radical cuts government spending, the only details that Ryan supplies are in his privatization scheme for Medicare. Since I have already shown in numerical detail how that would, in effect, help balance the budget on the backs of the retired and elderly, I'd like to take a look at the more general scope of the Republican plan as reported in the CBO document.

First of all, CBO makes the following deficit projections, as percentages of Gross Domestic Product or GDP. ("As is" means under current law; the signs -/+ mean, respectively, deficit and surplus):

Product (GDP):

Year: 2010 2022 2030 2040 2050 As is: -9% -2.75% -4% -4.5% -4% Ryan: -9% -2% -1.75% +.25% +4.25%

The report projects that current cumulative debt would reach 90% of GDP under current law by 2050, but only 10% under the Ryan plan. Many economists would describe a public debt of 90% as being "unsustainable."

At this point we must note the following from the CBO report:

1. Although the Ryan plan specifies a sharp reduction in non-health spending "from 12% of GDP in 2010 to 6% in 2022 and 3.5 % by 2050...the proposal does not specify the changes to government programs that might be made in order to produce that path" (my italics).

2. The Ryan plan would reduce non-health and non-Social Security spending "far below historical levels relative to GDP" (p. 4).

3. Even the CBO suggests that "It is unclear whether and how future lawmakers would address the pressures resulting from the long-term scenarios or the proposal analyzed here" (p. 4).

In effect, the CBO is wondering what will happen when either government debt rises to "unsustainable levels" (if it ever does), or what will happen when severe cuts in non-health spending mandated by Ryan's plan compromise government programs designed to insure the quality of our food, water, air and roads, and the enforcement of our laws. We've already seen that the Ryan plan virtually guarantees that all but a tiny wealthy minority of retirees will not be able to afford the $2000 per month per person estimated cost of obtaining "Ryan-care" in ten years (see the CBO figures I report on in Part I).

The philosophy of the Republican plan is well-captured by the following telling quote from the CBO report (p. 14).

"The proposal would change the nature of the entitlement under Medicare and Medicaid. Current law prescribes the health care benefits to which people are entitled, and the federal government pays whatever is needed to honor those entitlements. The proposal [Ryan plan] changes that entitlement to a fixed federal contribution."

Again, on page 17, we read:

"Although the uncertainty in future federal spending on health care would be lessened under the proposal, that uncertainty would be transferred to future beneficiaries. If the volume, complexity, and costs of medical services turned out to be greater than expected, future beneficiaries would pay higher premiums [to their profit-making private insurance company] and cost-sharing (i.e. deductibles, caps and copays] amounts than are currently projected."

Unlike the recent 2010 Health Care Act, which cuts costs of healthcare by having panels of doctors and other experts evaluate the effectiveness of various treatments, the Ryan plan rations healthcare by economic means. A fixed dollar amount, which is not geared to actual increases in healthcare costs but to a slower-rising index (Urban CPI), will almost immediately be inadequate to pay premiums for average senior citizens. While Republicans decry attempts to control costs by rational and democratic means, they are in effect controlling benefits by direct economic rationing.

By extension, the same philosophy underlies the Republicans' approach to government in general. Instead of asking what our citizens need, they specify how much we can spend -- and never how much we can raise collectively -- and then let the chips fall as they may.

The Congressional Budget Office did its job in evaluating the Ryan budget proposal -- at least as far as it could, given the lack of details in the proposal itself. However, it is important to note the limitations of the report.

1. Continuing Medicare as is -- the Extended-baseline-scenario -- or even granting some of the reforms of the Health Care Act of 2010, are not the only alternatives. Greater control of private profits -- say of the Pharmaceutical companies, which charge other countries far less for their medicines -- can save more money; so can a more effective public voice in covered treatments. Preventing doctors from having a financial interest in medical technology -- for example, owning MRI companies (see: GAO report) -- can save a tremendous amount of money in diagnosis and treatment. Instituting a Single-payer or "Public Option" would save the most, since it would eliminate payments to stock and bond holders -- unearned money lost to the healthcare system. Single-payer is a far less radical and more democratic idea than just about anything in the Ryan plan, and would change the whole set of axioms that restrict the CBO analysis; it also has lot of public support.

2. Returning to reality in the form of analyzing the plans in other countries (even, gasp, Europe) would help find out why they can spend less and get better results (better care) than we have been able to obtain.

3. We can save vast amounts of money, and cut our deficits dramatically, by Bringing Home the Troops. We can cut the billions we spend on unnecessary overseas military bases: Japan and Europe certainly come to mind. These savings don't figure as alternatives in the CBO report of course.

4. Cut subsidies to businesses that don't need them: Big Oil and Big Agri certainly come to mind.

5. Institute a sales tax on stock and bond sales and purchases. A small percentage (say 1/4% on both seller and purchaser) would hardly affect serious investors, but would make speculators think twice about the thousands of churning trades per second they make, which extract money from our economy without any productivity.

Finally, as many have pointed out, we need deficit spending now, to help restore our economy and provide jobs and tax revenue to our country. Nobody was worried about what deficits might be in 2050 when we had decent employment and before Wall Street cheated us. There is not a whit of evidence to support the idea that draconian tax cuts will at all restore our economic well-being; in fact, the evidence is just the opposite.

These are all things that the CBO report could not discuss given the narrowness of its appointed task. Instead of bankers, we should read economists such as Paul Krugman and Joseph Stiglitz (both Nobel winners) to find out what we should be doing in the next few years, as well as in the next 20 - 30 years: the two things are not the same.

Thursday, June 9, 2011

Detour into Geitner

Obama had no trouble having Geitner confirmed, and the Republicans never complained about Summers -- they are both dependable voices for the wealthy and banks in particular. On the other hand, Elizabeth Warren, who doesn't come from a big bank or insurance company, will never be confirmed as head of the Financial Regulatory Commission. That's 'cause the Party for The Rich knows she would actually do some regulating.

Sunday, June 5, 2011

The CBO report Part I: Healthcare Computations

There has been a lot of discussion about what will happen to Medicare if Rep. Paul Ryan's budget proposal ever becomes law. Democrats have claimed that Medicare will, in effect, be ended, and that people retiring in the future will be faced with huge increases in their healthcare costs -- perhaps $1000 or more per month. Republicans have claimed that this is a lie and a scare tactic, that Medicare will simply be changed somewhat, and that reports of huge premium increases are simply exaggerations. Both sides cite a report by the Congressional Budget Office (CBO) called A Long-Term Analysis of a Budget Proposal by Chairman Ryan. The full text (pdf) can be found HERE.

Since there seems to be some controversy as to what this report actually says, I downloaded it and spent some time reading it; my wife, who is also a mathematician and has studied finance, did the same. Here is what we found out.

First of all the report deals with budgets and deficit projections mostly related to Ryan's plan to convert Medicare from a "single-payer" government program to a voucher-based plan entirely based on private insurers. In Ryan's proposal, participants would purchase a health insurance policy from an approved vendor through a Medicare "Exchange"; vendors would have to insure all qualified (by age and citizenship) applicants, and could base their charges only on age, not on physical or pre-existing conditions. Coverage would be optional (no personal mandate) and not subject to any of the provisions of the 2010 Healthcare Reform Bill. The age of eligibility would gradually increase to 67 in 2033.

In order to help beneficiaries of the program ("seniors") pay for private insurance, the government would provide uniform supplementary payments which would grow over time only with the "Urban Consumer Price Index." (There would also be some transfer of funds from plans with healthier members to plans with less healthy one, though it is unclear how or to what extent this would work; in any case, it would not affect the premiums that retirees pay.) These voucher payments from the government would go directly to the private insurers, exactly the same way that tuition payments would go to directly to schools under so-called "education voucher" programs championed by Republicans.

People currently on Medicare, or who would be eligible for Medicare before 2022, would be allowed to enroll in and be covered by traditional Medicare for as long as they wish. Younger people (basically age 55 or under now) would have to enroll in the Ryan plan. In effect, those currently retired people who only care about their own healthcare (and not that of younger friends, relatives, or fellow cititzens) need not worry about the Ryan plan.

So what will happen, according to the CBO, to people retiring in 2022 or later?

In order to analyze this, the CBO makes certain important definitions.

1. First of all is the baseline healthcare cost. This is the amount it would cost an average 65-year-old to purchase private health insurance comparable to what Medicare now covers. "Comparable" is a tricky term, since all policies, including Medicare, have built-in deductibles and co-payments. Thus, taking these into account, Medicare pays for about 80% of total expenses (actually 76%), statistically. The CBO mentions this specifically, and we adjust for that in our computations (see below).

2. Current Medicare expenses and their extrapolation forward is called the Extended Baseline Scenario. This scenario only applies to folks allowed to continue in traditional Medicare after 2022, and is included for comparison between Medicare and "Ryan-care".

3. Various changes to revenue (most lower) and outlays (mostly higher) based on proposed legislation other than the Ryan plan has been labeled the Alternative Fiscal Scenario. This includes extension of the 2003 tax cuts, changes to provider compensation (e.g. to doctors) and other proposed or passed legislation. This Alternative Scenario is similar to the Extended Baseline Scenario above, but is more expensive.

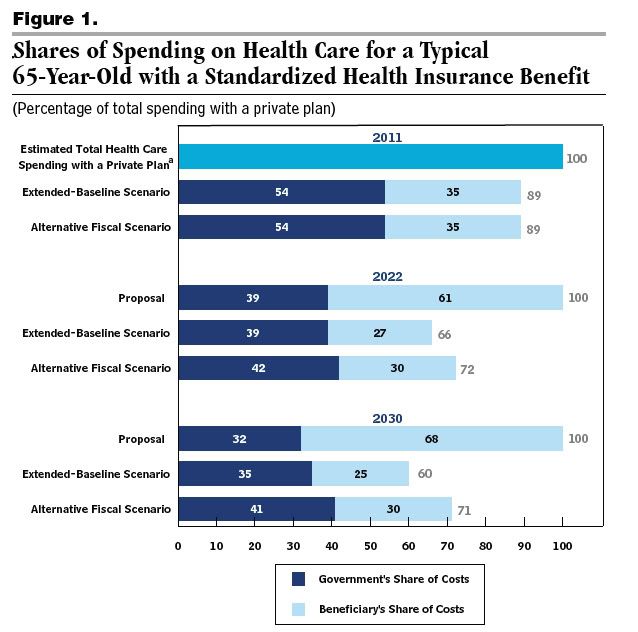

We now come to the key table which summarizes CBO's analysis of the costs to government and to the individual of the Ryan plan versus (traditional) Medicare:

The first three lines show the situation now. The cost of Medicare coverage is about 89% of the cost of a comparable private plan. Since everything is related to this baseline private plan, we see that the government pays, for each individual, 54/89 = 60% (approx) of the cost of insurance, while that individual pays the remaining 40%. For example, a typical senior age 65 might pay Medicare premiums of $150 per month (Medicare parts B and D) and another $150 per month for supplementary insurance. (The CBO, in a note to this table, says "A beneficiary's spending includes premiums, out of pocket costs for covered services, and payments for any supplemental insurance; see point 1 above). This comes to $3600 per year, which according to the chart is 35% of the cost of a private plan. Thus, a simple computation gives the cost of a private plan to be about $10,000 and the cost of Medicare coverage to be about $9000 -- split between $3600 individual and $5400 government contributions.

Now let's look at what happens in 2022 when the Ryan plan kicks in. On page 23 of the CBO report we see that it estimates the premium support (government) to be $8000 for a typical 65-year-old (both for Medicare and Ryan-care). According to the chart above, this is 39% of the baseline private plan cost. To find the individual's contribution, you multiply: $8000 x 61/39 = $12,512; this amounts to a charge of about $1000/month for new retiree (age 65). For a senior on traditional medicare, however, the individual contribution would be $8000 x 27/39 = (about) $5538. Thus, the Ryan plan would add about $7000 to the cost of insurance for an average 65-year-old person in 2022.

However, 65 is not the typical age of a retired person, and the Ryan plan (unlike traditional Medicare) allows extra charges based on age. For example, on page 8 the CBO document estimates the average government expenditure over all retirees 65 and older to be $15,000, not $8000. Applying the same calculation as above shows that the cost to an individual under the Ryan plan would be around $23,468 (nearly $2000 per month), while the cost under traditional Medicare would be only about $10,384. The difference is $13,084.

Thus, the average retired person in 2022 would have to pay more than $1000 per month extra under the Ryan plan.

These calculations, based entirely on tables and data from the CBO report, clearly confirm the assertions made by Democrats about the costs to senior citizen retirees under the Ryan budget plan.

Finally, the CBO report mentions in at least 10 different places (pp. 4, 15, 17, 19, 21, 23) that the Ryan plan would increase costs for participants starting in 2022. The Ryan budget overall cuts government programs -- especially Medicare -- while keeping taxes level or reducing them. Since retirees, especially the poorer ones, pay little in taxes, this clearly has the effect of cutting the budget at the expense of these senior citizens. In fact, as the calculations we made above (more than $2000 per month premiums) show, very few of these people would be able to afford healthcare under the Ryan plan. Their choice would be to do without, or hope for the best at emergency rooms. (And who will pay for that?)

Next time I'll discuss more general deficit issues raised by the CBO report.

Saturday, June 4, 2011

Republicans and the Big Lie: Part LXVIII

So, the Democrats have been airing a spot in which a NH woman explains why she is now opposed to Charlie Bass even though she voted for him in the past: the main reason is that he voted to end Medicare.

Not so, say Republicans. They claim that their plan is Medicare, since they choose to call it that. Of course, we all know what Medicare is, and a voucher system it is not. That doesn't prevent the PTR from engaging in a bit of, how shall we put it delicately... lying.

Of maybe, in the words of the immortal John Kyl: "It was not intended to be a factual statement."

The PTR demanded that Comcast take the ad off the air. Comcast refused. Will the Party for The Rich now take them to court? Is "beneath contempt" an absolute, or can one be lower than beneath contempt?

Wednesday, June 1, 2011

Trucks and roads

There is another reason to crack down on heavy trucks driving through city streets. Most people don't realize that the damage to paved roads done by vehicles is not proportional to the weight, but proportional to the fourth power of the weight. Consider the case of the 10,000 pound truck. Comparing this to a large (4000) pound car, the ratio is 10,000/4000 = 2.5. However, the wear and tear on the roads is is proportional to the fourth power of 2.5 which is a little more that 39. Thus, a 5 ton truck does nearly 40 times the damage as a 2 ton car. The owner of such a truck does not pay anywhere near 40 times the taxes that the owner of the car does. This is another form of subsidy for the trucking industry.

This phenomenon is well-known to civil engineers and is called the "Fourth Power Rule". For more details and further technical references, see my blog on this issue (Wednesday, October 7, 2009).