There has been a lot of discussion about what will happen to Medicare if Rep. Paul Ryan's budget proposal ever becomes law. Democrats have claimed that Medicare will, in effect, be ended, and that people retiring in the future will be faced with huge increases in their healthcare costs -- perhaps $1000 or more per month. Republicans have claimed that this is a lie and a scare tactic, that Medicare will simply be changed somewhat, and that reports of huge premium increases are simply exaggerations. Both sides cite a report by the Congressional Budget Office (CBO) called A Long-Term Analysis of a Budget Proposal by Chairman Ryan. The full text (pdf) can be found HERE.

Since there seems to be some controversy as to what this report actually says, I downloaded it and spent some time reading it; my wife, who is also a mathematician and has studied finance, did the same. Here is what we found out.

First of all the report deals with budgets and deficit projections mostly related to Ryan's plan to convert Medicare from a "single-payer" government program to a voucher-based plan entirely based on private insurers. In Ryan's proposal, participants would purchase a health insurance policy from an approved vendor through a Medicare "Exchange"; vendors would have to insure all qualified (by age and citizenship) applicants, and could base their charges only on age, not on physical or pre-existing conditions. Coverage would be optional (no personal mandate) and not subject to any of the provisions of the 2010 Healthcare Reform Bill. The age of eligibility would gradually increase to 67 in 2033.

In order to help beneficiaries of the program ("seniors") pay for private insurance, the government would provide uniform supplementary payments which would grow over time only with the "Urban Consumer Price Index." (There would also be some transfer of funds from plans with healthier members to plans with less healthy one, though it is unclear how or to what extent this would work; in any case, it would not affect the premiums that retirees pay.) These voucher payments from the government would go directly to the private insurers, exactly the same way that tuition payments would go to directly to schools under so-called "education voucher" programs championed by Republicans.

People currently on Medicare, or who would be eligible for Medicare before 2022, would be allowed to enroll in and be covered by traditional Medicare for as long as they wish. Younger people (basically age 55 or under now) would have to enroll in the Ryan plan. In effect, those currently retired people who only care about their own healthcare (and not that of younger friends, relatives, or fellow cititzens) need not worry about the Ryan plan.

So what will happen, according to the CBO, to people retiring in 2022 or later?

In order to analyze this, the CBO makes certain important definitions.

1. First of all is the baseline healthcare cost. This is the amount it would cost an average 65-year-old to purchase private health insurance comparable to what Medicare now covers. "Comparable" is a tricky term, since all policies, including Medicare, have built-in deductibles and co-payments. Thus, taking these into account, Medicare pays for about 80% of total expenses (actually 76%), statistically. The CBO mentions this specifically, and we adjust for that in our computations (see below).

2. Current Medicare expenses and their extrapolation forward is called the Extended Baseline Scenario. This scenario only applies to folks allowed to continue in traditional Medicare after 2022, and is included for comparison between Medicare and "Ryan-care".

3. Various changes to revenue (most lower) and outlays (mostly higher) based on proposed legislation other than the Ryan plan has been labeled the Alternative Fiscal Scenario. This includes extension of the 2003 tax cuts, changes to provider compensation (e.g. to doctors) and other proposed or passed legislation. This Alternative Scenario is similar to the Extended Baseline Scenario above, but is more expensive.

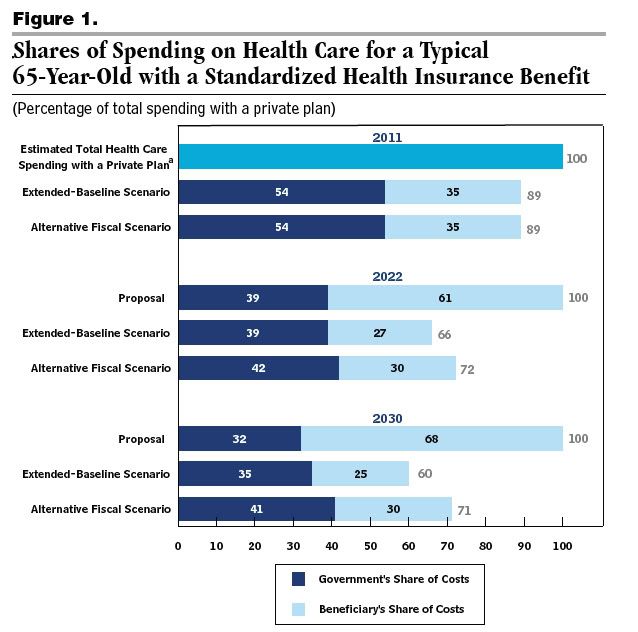

We now come to the key table which summarizes CBO's analysis of the costs to government and to the individual of the Ryan plan versus (traditional) Medicare:

The first three lines show the situation now. The cost of Medicare coverage is about 89% of the cost of a comparable private plan. Since everything is related to this baseline private plan, we see that the government pays, for each individual, 54/89 = 60% (approx) of the cost of insurance, while that individual pays the remaining 40%. For example, a typical senior age 65 might pay Medicare premiums of $150 per month (Medicare parts B and D) and another $150 per month for supplementary insurance. (The CBO, in a note to this table, says "A beneficiary's spending includes premiums, out of pocket costs for covered services, and payments for any supplemental insurance; see point 1 above). This comes to $3600 per year, which according to the chart is 35% of the cost of a private plan. Thus, a simple computation gives the cost of a private plan to be about $10,000 and the cost of Medicare coverage to be about $9000 -- split between $3600 individual and $5400 government contributions.

Now let's look at what happens in 2022 when the Ryan plan kicks in. On page 23 of the CBO report we see that it estimates the premium support (government) to be $8000 for a typical 65-year-old (both for Medicare and Ryan-care). According to the chart above, this is 39% of the baseline private plan cost. To find the individual's contribution, you multiply: $8000 x 61/39 = $12,512; this amounts to a charge of about $1000/month for new retiree (age 65). For a senior on traditional medicare, however, the individual contribution would be $8000 x 27/39 = (about) $5538. Thus, the Ryan plan would add about $7000 to the cost of insurance for an average 65-year-old person in 2022.

However, 65 is not the typical age of a retired person, and the Ryan plan (unlike traditional Medicare) allows extra charges based on age. For example, on page 8 the CBO document estimates the average government expenditure over all retirees 65 and older to be $15,000, not $8000. Applying the same calculation as above shows that the cost to an individual under the Ryan plan would be around $23,468 (nearly $2000 per month), while the cost under traditional Medicare would be only about $10,384. The difference is $13,084.

Thus, the average retired person in 2022 would have to pay more than $1000 per month extra under the Ryan plan.

These calculations, based entirely on tables and data from the CBO report, clearly confirm the assertions made by Democrats about the costs to senior citizen retirees under the Ryan budget plan.

Finally, the CBO report mentions in at least 10 different places (pp. 4, 15, 17, 19, 21, 23) that the Ryan plan would increase costs for participants starting in 2022. The Ryan budget overall cuts government programs -- especially Medicare -- while keeping taxes level or reducing them. Since retirees, especially the poorer ones, pay little in taxes, this clearly has the effect of cutting the budget at the expense of these senior citizens. In fact, as the calculations we made above (more than $2000 per month premiums) show, very few of these people would be able to afford healthcare under the Ryan plan. Their choice would be to do without, or hope for the best at emergency rooms. (And who will pay for that?)

Next time I'll discuss more general deficit issues raised by the CBO report.

I'm glad you mentioned in the last sentence that you'll discuss the deficit issues. Because that's precisely the issue. You say that Ryan's plan will cost more than under the Extended Baseline or Alternative Fiscal scenarios. That's true, but neither the Extended Baseline nor Alternative scenarios are likely to pan out. We know that the Alternative Fiscal scenario isn't possible because if debt goes over 100% of GDP (like it shows), then there will likely be major cuts to Medicare to get the debt under control. And the CBO admits that it believes the "Alternative" scenario is more likely than the Extended Baseline Scenario.

ReplyDeleteSo I think that the Medicare spending that the CBO projects under both the Alternative and Extended cases are highly unlikely to pan out. Which is why it's not a great benchmark.