First of all, whether there are tax cuts or tax increases, the history of capitalism in this country has always been one of recurring "business cycles." These comprise a period of growth (G) then a period of leveling off of growth (L) culminating in a peak (P); these are followed by recessionary periods of varied seriousness (R), then a leveling of decline (L), then a repetition. Schematically, then, we have the cycle:

The general path of the economy in the U.S. has been upward: most business cycles end in a recovery with the economy in a better state than it had been in the previous cycle, measured in terms of investment and GDP growth. On average this increment from peak-of-cycle P to peak-of-cycle P has been around 2%. There is also the matter of average (over the cycle) real tax revenue per capita; this is a measure of how much the government is actually taking in per person, adjusting for inflation.

Note the phrase "on average." Results do vary from cycle to cycle, which enables us to make comparisons between business cycles and tax policies. In the early '80s, under President Reagan there were a series of "supply-side" cuts in the tax rates, where "supply side" means favoring the investing class. Again, in the early years of the 21st century, the Bush Tax Cuts cut the rates for investors and the wealthy (both supply-side + "trickle down" theories at work). In between, in the '90s there were tax increases on the wealthy under President Clinton. How did these varying tax policies, based on competing economic theories, effect the business cycles?

The answers are quite clear. Comparing the Reagan and Clinton cycles, the recoveries from the recessionary periods of the respective business cycles were quite similar; (about 2%); however, the per capita tax revenues under the Clinton recovery were about twice the size as those under the supply-side Reagan recovery. Thus, the supply-side theory fared no better in terms of recovery, but was a real drag on government revenues. This is part of the reason that, rhetoric aside, the Reagan "conservative" theory resulted in deficits, while the Clinton administration actually achieved the budget balance that the Reaganites merely talked about.

Moving on to the next business cycles, the comparison between the Clinton and Bush years is even more noticeable. The improvement in the economy (investment and GDP growth), from P to P, from Clinton to Bush, was somewhat lower than the historic improvement, but the tax revenue increase was no more than 1/2 % -- virtually nil in comparison with the average over the last 50 years of about 10% (11% under Clinton).

Thus, in terms of economic recovery, there is no discernible difference between Republican/conservative and Democratic/liberal tax policies. But, in terms of real per capita tax

In the crucible of real-world testing of economic theories -- the only meaningful test, after all -- the conservative program has failed. As the handwriting on the wall says from Daniel 5: "Mene mene tekel upharsin" ("You have been judged in the balance and found wanting").

The data backing up these remarks comes from official statistics reproduced by the Center on Budget and Policy Priorities in this report. Please check it out: it has references to many other sources.

Now we come to "fairness" -- truly a thorny issues. Conservatives like to point out that after the Reagan and Bush tax cuts, the percentage of income tax collected from the top 1% (99th percentile) of tax payers went up, while the share from the lower income percentiles went down. This is supposed to show the liberals that cutting taxes for the rich is some sort of Robin Hood scheme. This is baloney for several reasons. First of all, the actual marginal (highest rate of taxation, or the tax on the last dollar of income) tax rates on the richest 1% are at an all-time low, so that the burden that they pay as individuals is lower than ever. So why are they paying more? One reason is that their income, in comparison with the incomes of the lower brackets, has soared in the last few years (since the '50s and '60s). The wealthiest 1% now make about 24% of all income; furthermore, their income is the highest multiple of the lowest percentile income since 1928: just before the Great Depression.

Here's how Nicholas Kristof of the NY Times puts it:

"The richest 1 percent of Americans now take home almost 24 percent of income, up from almost 9 percent in 1976. As Timothy Noah of Slate noted in an excellent series on inequality, the United States now arguably has a more unequal distribution of wealth than traditional banana republics like Nicaragua, Venezuela and Guyana.

C.E.O.’s of the largest American companies earned an average of 42 times as much as the average worker in 1980, but 531 times as much in 2001. Perhaps the most astounding statistic is this: From 1980 to 2005, more than four-fifths of the total increase in American incomes went to the richest 1 percent."

So, they pay a larger percentage of taxes because, in comparison, they are many many times wealthier. Even the top 5% have seen their real income more than double since the 1960s, while the real (adjusted for inflation) income for the lower brackets has remained amazingly constant since 1965. Another reason their tax contribution has gone up is not so much that their marginal rate has gone down but that the kinds of deductions which they can take have been tightened. These include certain business (no more "three-martini lunches e.g.) and certain limitations on mortgage and home equity interest deductions. Similar changes in the standard and child-care deductions have helped the people in the lower income brackets. Conservatives claim that lower tax rates have made the wealthy less likely to hire expensive tax preparers to find loopholes in the tax rules -- I don't buy this and I haven't seen anything but anecdotal evidence to support it.

Mother Jones magazine has compiled more statistics about taxes and incomes of the rich; you can find the article here.

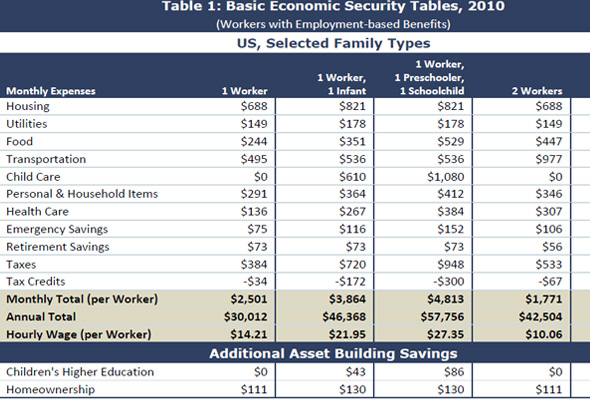

Now, of course, there are those who question why the wealthy should, in fact, pay higher (marginal) tax rates at all. Why, they ask, shouldn't everyone pay, say, 15% of their income? In other words, what justification is there for a graduated income tax? And here we come to the issue of fairness and the concept not so much of taxes as tax burden. To see what's at issue here, let's look at a hypothetical case. I got the following table from MainSt, a non-partisan middle-class financial magazine.

Column 4 represents the finances of a typical family of four with one wage earner. In order to afford the very basics of middle-class life, the hourly salary of the breadwinner must be $27.35 an hour -- with no savings for college and no homeownership. Note that there are absolutely no frills or leeway in this family's finances. One might say that this family has no disposable income. Thus, there is no money for vacations, gifts, parties or dining out. This family is slightly above the median for Americans.

Now imagine a similar family with a yearly income of $135,000, paying even triple the taxes of the first family. This family would have an additional $6,000 per month of income to spend at their discretion: to pay for a house, fancy vacations, tuition at a good college etc. This extra money also buys them less financial stress (which puts a great strain on marriages) and opportunities for personal enrichment such as plays, concerts, music lessons and sports. This family is somewhere in the top 5-10% of American families: not rich by any means, but firmly secure.

It is clear that the tax burden of the second family is far lower than that of the first. In the interest of fairness, we believe that every hard-working family deserves a measure of financial security, educational opportunity, and even a little left over (disposable income) for recreation and relaxation. Thus, to allow this, generations of Americans have agreed that the tax burden be shifted to those families with more disposable income.

To do this, we have a graduated income tax, with gradually increasing rates of taxation for the various segments of a taxpayer's salary, starting from the lowest. Thus, one might pay nothing for the first $20,000, 10% on the next 20,000, etc, up to the highest segment which is taxed at the "marginal" rate. At one time there were literally dozens of segments, and the tax forms had very simple charts where you looked up your taxable income; the chart said something like: "Pay $3700" plus [some percentage] of your income over [a certain number of dollars]." Even before calculators, you just needed one multiplication and one addition to find what you owed.

Another possibility is to have a fixed tax rate for all "earned income" (as we do in Massachusetts), but with a large initial exemption (amount subtracted before calculating taxes) to account for fixed expenses (non-disposable income) -- the theory being that the government should notextract tax money on what you need simply to live. This kind of tax system is not as fair as the graduated one, but it is hard to get people to see this because most people don't want to do the math to make the comparison. When Massachusetts had a referendum on the graduated income tax, large businesses and wealthy people launched a campaign that eventually convinced a large majority of the people who would have benefited from this reform to vote against it. (Opponents said that the calculations would be too complicated to understand, and that, by some infernal, magical gimmick, "the government" would somehow extract more money from you: the usual Big Lie propaganda technique.)

Anyway, thanks for you patience if you've read this far.

You don't think that changes in tax policy can affect individuals and businesses actions on the margin? Such tax changes could lengthen or shorten the various sub-segments of the business cycle?

ReplyDeleteIf you use the coefficient of correlation to compare various tax rates vs. various periods of growth you see that there is in fact no correlation between the two. Markets are irrational, the only thing we can "control" is how hard we get hit during recessions.

ReplyDeleteShould rich people pay more income tax?

ReplyDeleteIncome earned 35%. Income from capital gains 15%.

Lower their income tax, since this is what they actually earn. This would be rewarding "new money". On capital gains increase the tax rate. Perhaps not to 35% but it should be higher, because all they do is sit on their asses and rake it in.

This is most fair. And no taxes on first $20k-$30k income on those earning less than $x/year. Some people are fucking starving to death. They don't make enough money and don't qualify for food stamps.

For Anonymous:

ReplyDeletePlease rewrite your posting of January 25. It could use clearer wording; also, please remove obscenities -- I don't object to colorful language in private, but please not on this blog.

Thanks